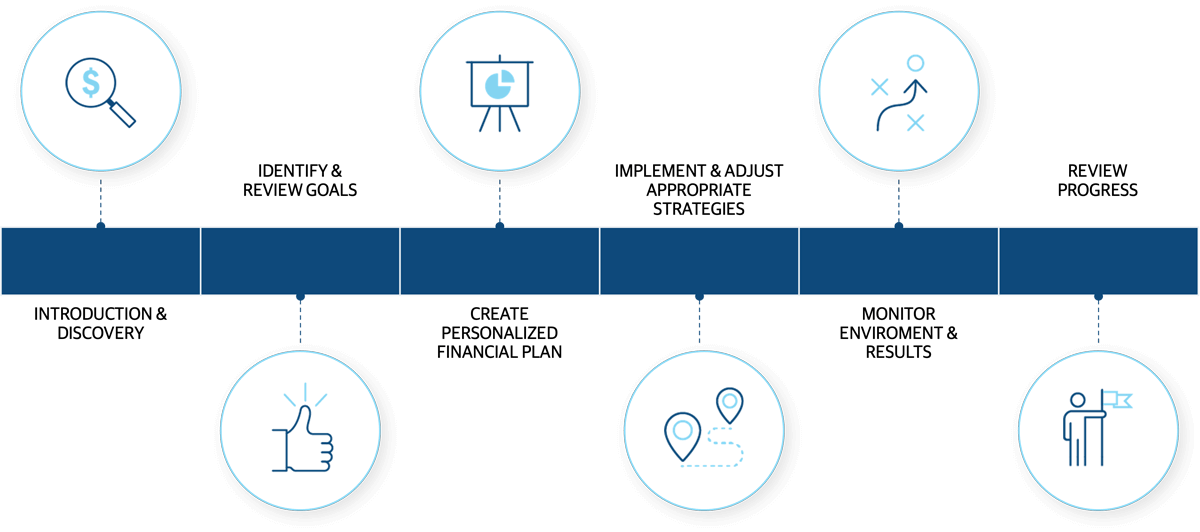

Our Planning Process

Financial Planning is a constant evolution of identifying, prioritizing, and executing on meaningful objectives that are deeply rooted in the vision you have for your life. Our planning process was built to cultivate lifelong relationships with our clients, so you feel financially secure today, tomorrow, and for generations to come.

Integrated Planning

Our clients ask us to be at the center of their financial lives. To do so, we develop and implement a plan that includes strategies unique to them.

Areas of focus often include:

Financial Planning

Wealth Management

Insurance Selection

Retirement Income Distribution

Business Planning

Estate Planning

Integrated Planning

Because your world is multifaceted, creating total alignment across professionals requires careful planning. Our advisors take the lead in coordinating the many aspects of your financial life.

In the areas that we don’t work directly, we serve as a filter between you, your family, and your key financial professionals. We can provide referrals to these professionals when needed and will often sit in on meetings to help ensure consistency across all areas of your financial plan.

YOUR FAMILY

INVESTMENT

MANAGER

INSURANCE

SPECIALIST

CERTIFIED

FINANCIAL

PLANNER™

Institutional Value

By creating an intentional partnership with Northwestern Mutual and their investment team, we have access to the high-caliber resources and expertise that helps us address our clients’ complex concerns. As a result, we’re able to deliver the best of both worlds—individual financial guidance from a boutique firm backed by an esteemed Fortune 100 financial institution.

Access to banking relationships like

BNY Melon & Tri-State Capital

Private Wealth Management

Access to institutional-level alternative investments like

Private Equity, Private Credit, Hedge Funds, Etc.

Top 10

Independent Broker Dealer2

Measured by 2022 revenueWealth Management

$257 Billion3

retail investment client assets held or managed by Northwestern MutualStrategic Partnerships with Trust Companies

1Among U.S. life insurers. Ratings are for The Northwestern Mutual Life Insurance Company and Northwestern Long Term Care Insurance Company, as of the most recent review and report by each rating agency. Ratings as of: 06/23 (Moody’s Investors Service), 08/23 (A.M. Best Company), 08/23 (Fitch Ratings), 05/23 (S&P Global Ratings). Ratings are subject to change.

2Ranking for Northwestern Mutual Investment Services, LLC (NMIS) based on total 2022 AUM, which includes figures that combine NMIS brokerage account activity and AUM with account activity and AUM of investment advisory account of NMIS’s affiliate Northwestern Mutual Wealth Management Company (NMWMC), which are held through NMIS. Source: Financial Advisor, April 2023.

3Combined client assets of Northwestern Mutual Investment Services, LLC (NMIS) and Northwestern Mutual Wealth Management Company (NMWMC). The advisory programs offered by NMWMC are in conjunction with brokerage services from NMWMC’s affiliate, NMIS. NMIS is a wholly owned subsidiary of Northwestern Mutual.